Tax season is stressful. So stressful that even the IRS offers tips to cut down on tax season-induced stress. One of the first tips: gather your records. For authors, that can be tricky. But if you use IngramSpark to print and distribute your book, getting your records from there is pretty simple.

Here’s how to download all the info you need on sales through IngramSpark.

Downloading Compensation Reports from IngramSpark

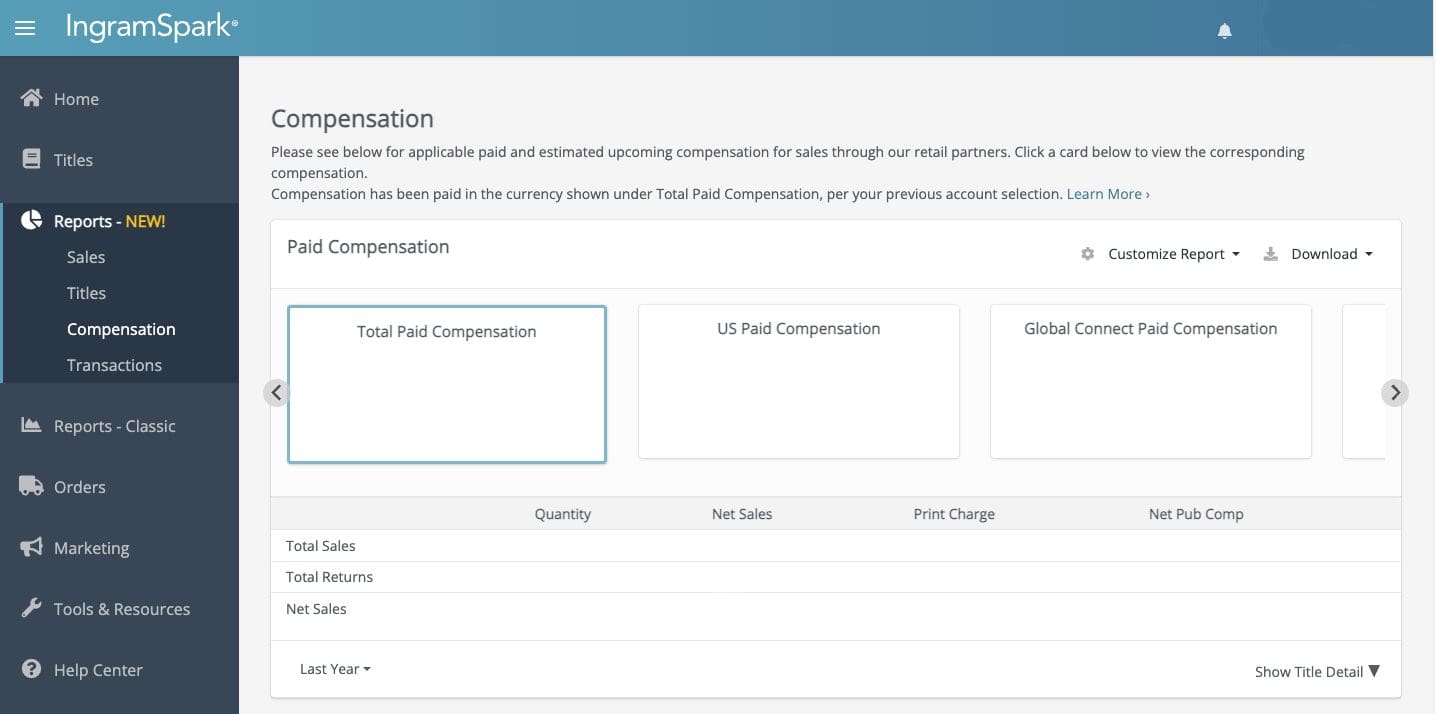

- Log in to your IngramSpark account.

- Click on Reports – NEW!

- Click Compensation under the Reports – NEW! tab.

- Under Paid Compensation, click on the dropdown menu on the bottom left. Choose Last Year. The amount of money you made through online sales shows up in a box titled Total Paid Compensation. This is the number you want.

- Either write down the amount shown in Total Paid Compensation or click Download on the top right of the Paid Compensation box and choose your preference.

What Else Authors Need for Tax Season

If you’ve worked hard to sell your book, your IngramSpark compensation isn’t all you need for tax season.

When getting ready for tax season, authors should have the following information on hand:

- Cost of books, magazines, or trade organization memberships purchased in order to learn about marketing or writing or develop professional relationships or skills related to your writing career

- Marketing expenses, including the cost of books you bought to give away or sell; promotional posters, postcards, t-shirts, etc.; advertisements in newspapers, social media, etc.

- Money made via in-person, consignment, and other book sales

- Upfront investment to create your book

But First, You Have to Publish

Wish you had book sales to report on your taxes? Before downloading IngramSpark tax information, you need to publish your book. Don’t wait until tax season rolls around again to set your dream into motion. Submit your manuscript for consideration today.